ACCA = Global

Accountant

Time Taken – 1/2 of

Traditional

Accounting Courses

Get placed at Big 4’s

Duration

1.5 to 3 Years

Schedule

Weekend, Weekday & Self-paced options

Pass Rates

Higher pass rate than global pass rate

Fees

EMI starting from ₹9,000/month

Duration

1.5 to 3 Years

Schedule

Weekend, Weekday & Self-paced options

Pass Rates

Higher pass rate than global pass rate

Fees

EMI starting from ₹9,000/month

What is ACCA Course ?

Association of Chartered Certified Accountants

- •ACCA = Global Accountant

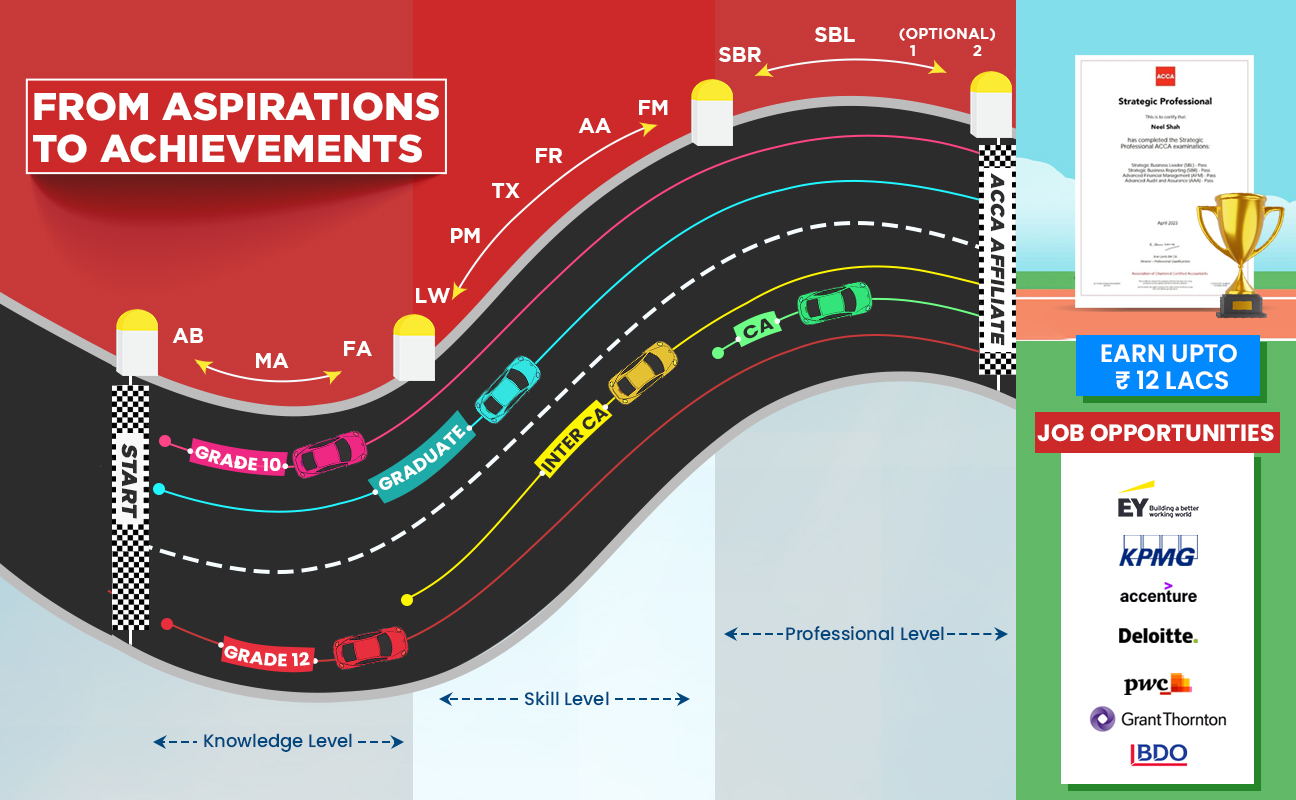

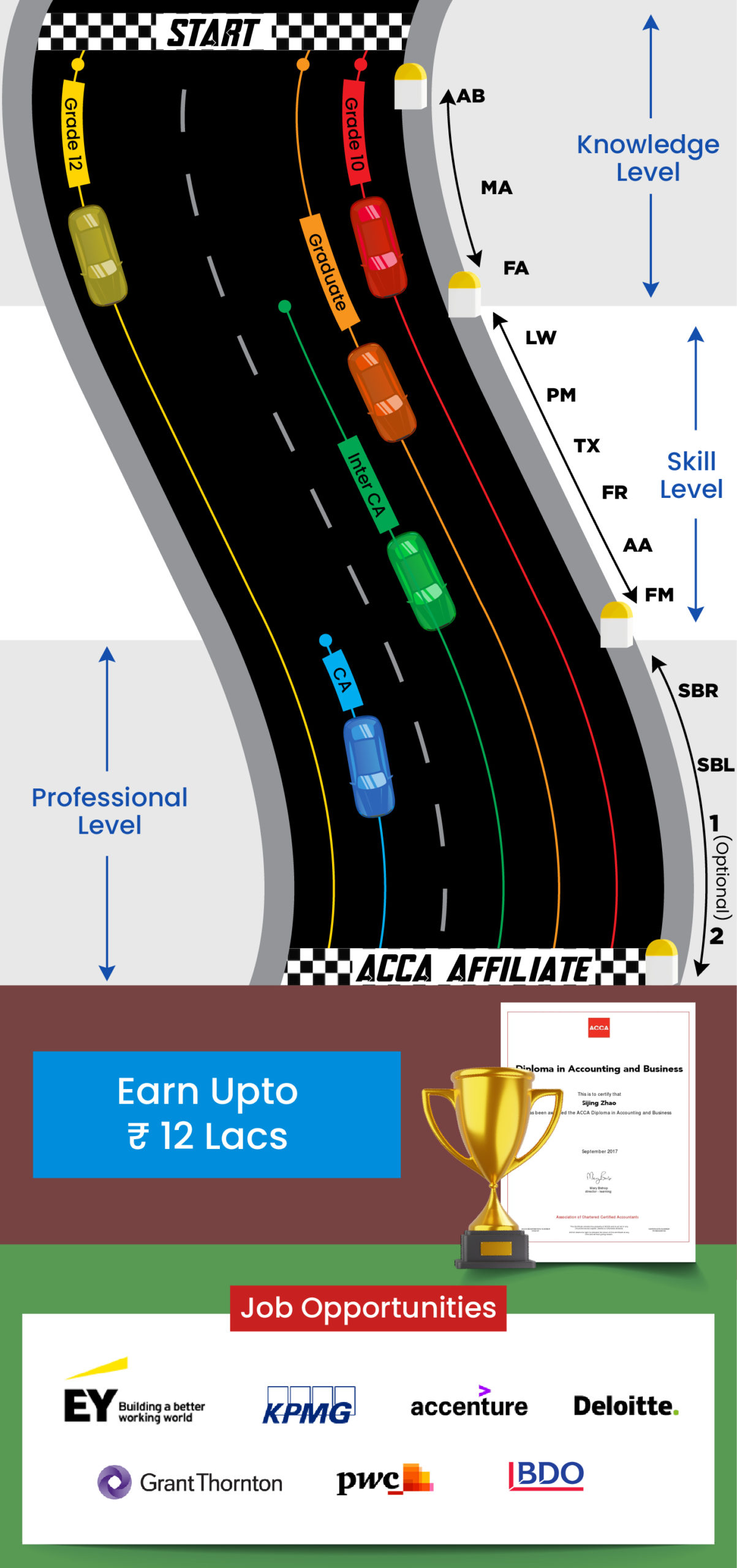

- •Eligibility – Grade 10 Cleared

- •Popularity – 5x Yearly Growth

- •Jobs Available – 64,000 (source – naukri)

- •Salary Range – Upto ₹12 Lac p.a

ACCA Course Syllabus

ACCA is a prestigious global professional accounting certification. It offers a comprehensive qualification that equips individuals with the skills … read more

- •Business and Technology (BT)

- •Management Accounting (MA)

- •Financial Accounting (FA)

- •Business and Technology (BT)

- •Management Accounting (MA)

- •Financial Accounting (FA)

ACCA Course Exemptions

DEGREE |

NO. OF EXEMPTIONS |

BCom/ BBA |

Upto 4 |

IPCC Cleared |

Upto 6 |

Qualified CA |

Upto 9 |

Our ACCA Course Faculties

Zell – ACCA Coaching in India

Why Zell

- •Flexible Mode of Training

- •100% Placement Assistance

- •ACCA Members as Trainers

- •1.5 Lac+ Students Impacted

- •Tailored 1:1 Mentorship Advantage

ACCA Certification Rank Holders

Get on the path to becoming a rankholder

Zell Alumni Works Here, You Could Too

Zell Alumni Works Here, You Could Too

Student Reviews for ACCA Course

ACCA Course Fees

OFFERINGS

Knowledge Level

Skill Level

Professional Level

WEEKDAY

1,26,000

1,57,500

WEEKEND

88,000

1,26,000

1,22,850

SELF-PACED

52,000

67,500

52,000

PARTICULARS

Live Online Lectures

Lecture Recordings

LMS Access

Unit & Mock Tests

Test & Mock Feedback

Zell Study Material (Hard Copy)

Zell Study Material (Soft Copy)

Free Registration Support

Placement Assistance

WEEKDAY

WEEKEND

SELF-PACED

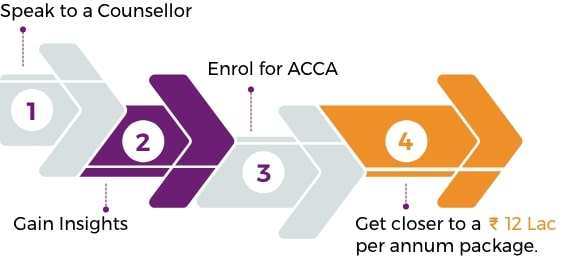

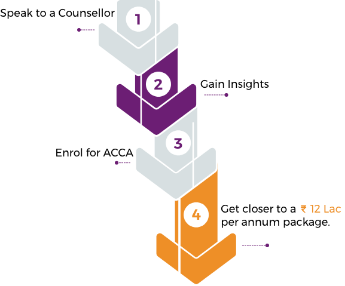

ACCA Certification Course Roadmap

ACCA Course FAQs

What is the ACCA certification?

ACCA, which stands for the Association of Chartered Certified Accountants, is a globally recognized professional accounting body. It offers the ACCA certification, which is well-known in the accounting and financial industry. The ACCA qualification provides individuals with comprehensive knowledge and skills in accounting, finance, and business management. It covers a wide range of areas, including financial accounting, management accounting, taxation, audit and assurance, financial management, and business ethics. ACCA’s focus is on developing accountants who possess not only technical expertise but also the necessary professional skills and ethical values to succeed in their careers. The qualification equips individuals with a deep understanding of financial principles, enabling them to analyze complex financial data, make informed business decisions, and provide strategic guidance to organizations.

What is ACCA course salary?

After completing ACCA, the average salary offered in India for a ACCA is ₹5,07,369 as per glassdoor and £48,500 (48 lakhs INR) per year as per Kanan. Your salary expectations can vary depending on factors like your location, industry, and experience level. Generally, ACCA opens up opportunities for competitive salaries in the accounting and finance field. Entry-level positions typically offer moderate to above-average salaries, with potential for significant growth as you gain experience. It’s important to research salary data specific to your area and industry to get a more accurate estimate. Networking, seeking guidance from mentors, and engaging with professional accounting organizations can provide valuable insights. Remember that salary is just one aspect of career satisfaction, and factors like job responsibilities, growth opportunities, work-life balance, and personal fulfillment should also be considered when evaluating your overall career prospects.

Is ACCA demanded in India?

Yes, ACCA enjoys significant demand in India. With the country’s increasing integration into the global market, ACCA’s global recognition and comprehensive curriculum makes it a sought-after qualification. Many multinational corporations and international accounting firms operating in India highly value ACCA professionals for their technical expertise and global perspective. The flexibility offered by ACCA allows individuals to pursue the qualification while balancing work commitments, making it an appealing choice for Indian professionals seeking career advancement. ACCA’s emphasis on ethical conduct aligns with the growing importance of transparency and compliance in the Indian business environment. Overall, ACCA’s global recognition, comprehensive curriculum, and flexibility contribute to its strong demand in India, providing Indian professionals with enhanced career prospects and opportunities for growth.

Who is eligible for ACCA in India?

The eligibility criteria as per the ACCA body states that the person who wants to pursue the course should be a 10th class pass out. Students who are 12th class pass out or hold a degree in any commerce background (BCom, BAF, BFM, BMS in Finance) with at least 65% is English and Accounts/Mathematics each and 50% in the rest of the subjects are eligible for ACCA. However, for learners who do not meet the eligibility criteria mentioned above and wish to pursue the course, they can do so by applying for the Foundation in Accountancy (FIA) program which allows students to begin their ACCA journey right after they pass their 10th class. By completing FIA, the student will have completed the first three levels of the ACCA.

Is the ACCA course recognized internationally?

Yes, the ACCA qualification is globally recognized and respected. It is highly regarded by regulatory bodies, employers, and professional accounting organizations in more than 179 countries such as the UK, Switzerland, Turkey, US, Canada, Australia, etc. With a comprehensive curriculum covering accounting, finance, taxation, and auditing, ACCA equips individuals with a deep understanding of these subjects. The qualification’s global recognition is further bolstered by mutual recognition agreements with international accounting bodies, enabling professionals to obtain local qualifications and enhancing their career mobility. Employers, including multinational corporations and financial institutions, actively seek ACCA-qualified individuals due to their technical competence, ethical standards, and business acumen. Overall, the ACCA qualification’s worldwide recognition makes it a valuable asset for those aspiring to build successful careers in accounting and finance on an international level.

How many years is the ACCA course?

The duration to complete the ACCA course can vary. On average, it takes approximately 3 years to complete ACCA. The qualification consists of multiple levels, including Applied Knowledge, Applied Skills, and Strategic Professional. The time required depends on factors such as prior qualifications, study commitment, and individual circumstances. Some students may complete the course in a shorter time by taking advantage of exemptions or studying intensively. ACCA offers flexibility, allowing individuals to progress at their own pace, balancing studies with work or other commitments. The availability of online resources and support from ACCA-approved learning providers enhances flexibility.

Is there any scholarship for ACCA students?

No, the ACCA’s body do not provide any scholarships.However, since Zell Education is a platinum approved partner with ACCA, for students that are eligible for exemptions based on higher qualification such as Commerce graduates, Post Graduate (M.Com), Inter CA students, and CA qualifiers might be eligible for exemption waiver codes that will help reduce your exemption fees by a lot!

Speak to An ACCA Course Expert